VAT in Malaysia known as Sales and Service Tax SST was introduced on September 1 2018 in order to replace GST Goods and Services Tax. In Malaysia a person who is registered under the Goods and Services Tax Act 201X is known as a registered person.

The threshold starting from 1 June 2013 and the business is liable to be registered for GST within twenty eight days from this date ie.

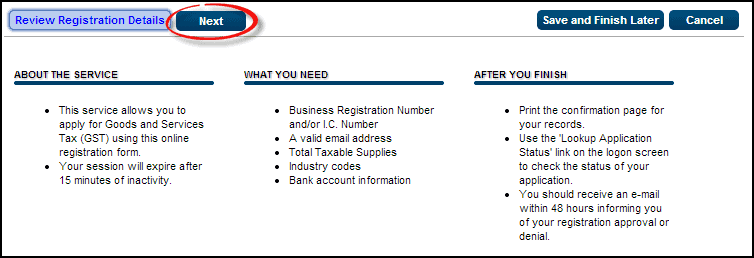

. Then click on the Next button to go to the next. Must a Malaysia company collect GST when exporting goods or services out of Malaysia. In Malaysia a person who is registered under the Goods and Services Tax Act 201X is known as a registered person.

List of Taxable Non-taxable Items. Any business with a yearly turnover in excess. However the company will still need to register with Customs Department in order to claim back GST paid on the purchases expenses.

Use self-billed invoice Set this option to Yes if you must issue self-billed invoices in some circumstances. A registered person is required to charge output tax on. Limited Liability Partnerships LLP T08LL1234A.

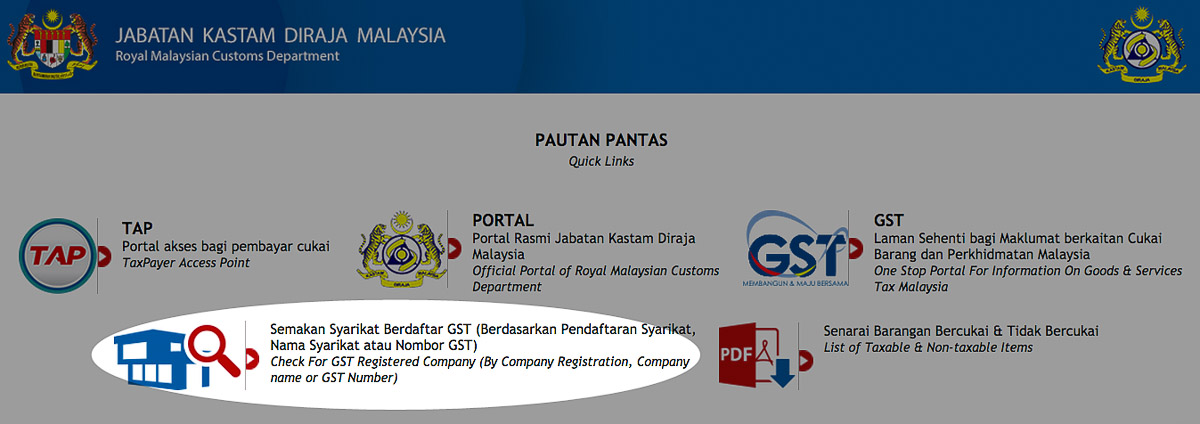

The standard goods and services tax GST in Malaysia is sales and service tax SST of 10. However business with taxable turnover of RM500000 and below even though not required to be registered may. Semakan Syarikat Berdaftar GST Berdasarkan Pendaftaran Syarikat Nama Syarikat atau Nombor GST Check For GST Registered Company By Company Registration Company name or GST Number Senarai Barangan Bercukai Tidak Bercukai.

RMCD is ready to accept application for registration from 1 June 2014. However in some case the Director General can upon written request allow. To avoid confusion on the customer the GST registered person must not issue tax invoice when only making exempt supply or out of scope supply non taxable supply.

How can I get GST number in Malaysia. Goods and Services Tax in Malaysia can only be collected by GST registered entities. From the suppliers perspective he will be entitled to a relief for bad debt if payment is not received within the same six month period and subject to meeting the.

GST invoice format Select either Full invoice or Simplified invoice as the printing format for GST invoices. It applies to most goods and services. The fixed rate is 6 and some types of goods and services can be exempt from this tax while others are taxed at different rates.

Sehubungan dengan itu sebarang pertanyaan dan maklumat lanjut berkaitan GST sila hubungi Pusat Panggilan Kastam 1-300-888-500 atau emailkan ke ccccustomsgovmy. Portal akses bagi pembayar cukai. Related information can be found and downloaded from these.

The Malaysia GST requires a GST-registered business which has made an input tax claim but fails to pay his supplier within six months from the date of supply to repay the input tax. Any person who makes a taxable supply for business purposes and the GST exclusive value of the taxable turnover of that supply for a period of 12 months or less exceeds the threshold of RM500000 is required to be registered for GST. Clubs Associations Societies Government Agencies Others.

Click Lookup GST Status. Input tax is the GST 2 Whether a business is GST-registered can be verified via the IRAS webpage wwwirasgovsg GST. As announced by the Government GST will be implemented on 1 April 2015.

VAT in Malaysia known as Sales and Service Tax SST was introduced on September 1 2018 in order to replace GST Goods and Services Tax. The first reduced SST rate 6 applies to restaurants hotels and accommodation car hire rental and repair domestic flights insurance credit cards legal and accounting business consulting electricity. Your business VAT number.

A special GST treatment to allow businesses to charge and account GST on the positive price margin from the sales of the second-hand goods. 23 Output tax is the GST that is charged and collected by GST-registered businesses from their customers and is to be paid to IRAS. To ensure a smooth implementation of GST businesses are encouraged to submit their application for early registration.

Obtain a copy of the GST TAP website and click the Register for GST hyperlink. Guide on How to Register for GST in Malaysia Step by Step Instructions Details of the company or business the name of the company or business as well as contact information. Business under GST group divisional registration Sole proprietorships Reference number for GST matters M91234567X MR2345678A.

Segala maklumat sedia ada adalah untuk rujukan sahaja. You are required to check GST Registration Status for A Business in Malaysia to ensure the tax invoice is valid for input tax claiming. The two reduced SST rates are 6 and 5.

Adalah dimaklumkan bahawa Portal MyGST ini tidak lagi dikemaskini semenjak GST dimansuhkan pada 31 Ogos 2018. This scheme which is called Margin Scheme to be applied only for goods motor vehicle only purchased from non-registered person and resold. VAT Registration in Malaysia.

Export goods and services are called zero-rated supplies and GST is not applicable. Most organizations use full invoices. By imposing GST on the margin this scheme avoids the.

GST Registration Number GST Reg No Description. If a Malaysia company is not GST registered can it collect GST tax. Zero-Rated Supply CompanyFor business that falls in Zero-Rated Supply category the business owner does not have to charge 6 GST even though the companys yearly sales exceed RM500 000.

Gst Registration Online Process Documents Fees Threshold

Non Resident Businesses And Operators Gst Registration Kpmg Canada

Goods And Services Tax Gst Malaysia For Manufacturing Sector

Functionality To Register Complaint Regarding Misuse Of Pan For Obtaining Gst Registration Introduced A2z Taxcorp Llp

Claiming Your Gst Refund As You Leave Malaysia Trs Economy Traveller

How To Check Malaysia Company Registration Gst Registration Status

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

How To Apply For Gst And Pan For A Partnership Firm Ebizfiling

Everything About Gst Registration Of A Private Limited Company Ebizfiling

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Sst Sales And Service Tax A Complete Guide

How To Start Gst Get Your Company Ready With Gst

Gst Change Of Address A Quick And Easy Online Process Ebizfiling

Malaysia Gst Guide For Businesses

How To Check Malaysia Company Registration Gst Registration Status

Benign Tax Consultants Home Facebook